Automatic stop loss.

Common questions.

After reading this article you will understand what an automatic stop loss is and why it is an essential tool for crypto trading.

Trading is a risky activity and investing in crypto is not different from investing in traditional markets:

“there is no free lunch”.

There is a constant trade-off between risk and reward.

Every time we buy a coin we basically believe to be smarter than our counterpart who is selling it to us. If the price goes up we win, otherwise, we lose.

We can think about trading as a zero-sum game, the amounts won by some investor equals the combined losses of the others.

- Why 95% of private traders lose?

- Why big banks and hedge funds keep trading and making money as opposed to private investors? Do they know something we do not?

- Why a stop loss is so important to be a winning trader?

Keep reading, you will find a general overview of the problem and some answers.

Psycological answer.

Nobody likes to admit he is wrong, especially when his money is involved: It’s obviously depressing. On the other side, we all love to be right, to be a winner: it gives us confidence and a little bit of euphoria.

When the above psychology is applied to financial markets the results are:

Traders underestimate losses.

They realize their investment is not going as expected. The number is red, there is a loss which is getting bigger and bigger. Nevertheless, they look for excuses to give themselves more time to stay in the trade. They think it’ s just a temporary market correction and soon the tide will turn. But that is only a way not to admit defeat and put off the bad feelings associated with a wrong decision.

Traders overestimate gain.

If my investment is going in the right direction I fell good, I belong to the winning group, I can make money with my brain just pushing a button on my screen and I do not want that situation to be reversed so I exit the trade to lock in my satisfying profit.

In the long run, this normal human behavior will end up losing a lot of money.

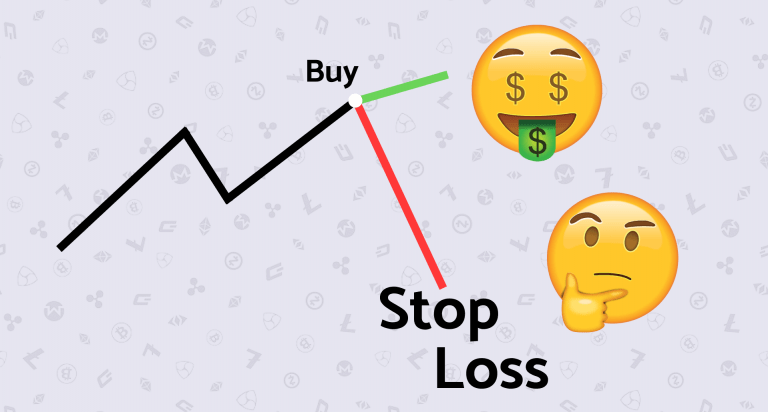

Solution: automatic stop loss

Traders working in a hedge fund invest other people’s money, therefore they are less involved. They are professional. Losses and risk management are a normal part of their job. If they lose too much money on a single trade they would probably be immediately fired. Even if they work for a small company an automatic risk management system is likely to be in place. A software monitors their investments constantly and If a loss exceeds a preset threshold the position will be automatically liquidated by the computer without any human intervention.

Comply with a strict exit rule is definitely one of the reasons why professional traders tend to be more profitable.

Stop losses are orders that a trader places at a specific price The automatic stop loss closes a position if losses exceed a certain level. They are an essential part of risk management.

There are three main stop loss types:

Full Stop Loss.

The full stop loss closes all your position in a coin when triggered. It’ s a full insurance against losses. In this case your investment idea was definitely wrong. That price simply went in the wrong direction and it is time to exit the trade. Do not worry because markets will open again tomorrow

Partial Stop Loss.

The partial stop loss can be thought like: convert 50% of my BTC in USD if BTC price goes below 8.000 USD.

In this case, the trade did not go as expected and you want to reduce the risk associated with that position. However, you still believe your idea might be right in the near future.

You are doing proper risk management. It would be a good idea to implement a new stop loss for the remaining part of your position.

Trailing Stop Loss.

The trailing stop loss value will adjust according to the crypto asset’s price fluctuations. The trader sets a trailing distance, which is the difference between the current crypto price and the stop loss value. If the price rises, the stop loss value will rise with it, but if the price drops, the stop loss value will not change and the order will be triggered if the stated value is reached.

Trailing stop loss follows the price. If the price goes up more then the trailing distance the stop loss would lock in a profit. An example will make it clear.

Let’s assume you bought a coin for 100 and set a trailing stop loss at 10 %. The first threshold value, which will trigger a sell order, is set at 90. If the price drops at that level you will have a 10 % loss as expected. If the price takes the other direction and reaches 120 your new trigger will be placed at 120 – (120*10%) = 108. At that level, your sell order will be executed and you will have a profit of 8%.

Advantages of automatic stop loss.

the main advantages of the stop loss automation when trading cryptocurrencies are:

- It removes all emotions from your trading decision.

- It forces you to follow your trading strategy and gives you discipline.

- It is the best defense against Volatility which, as we all know, is very high in Cryptomarkets. Protecting your investment is the only way to be profitable in the long run.

- It gives you more free time for other activities and reduces the overall stress. Cryptomarkets are open 24/7 and it would be impossible to constantly monitor your investment. But if you prefer you can stop sleeping. 😊

ShieldTrade allows you to easily calculate and set up an automatic stop loss.