Crypto CSV to Excel

Crypto CSV to Excel refers to the process of importing, normalizing, and reconciling cryptocurrency transaction data exported as CSV files from exchanges, wallets, and custodians, and making that data usable inside Excel.

In the crypto domain, CSV files are the primary way historical data is provided. However, Excel becomes reliable only after this data has been transformed into a coherent and standardized structure.

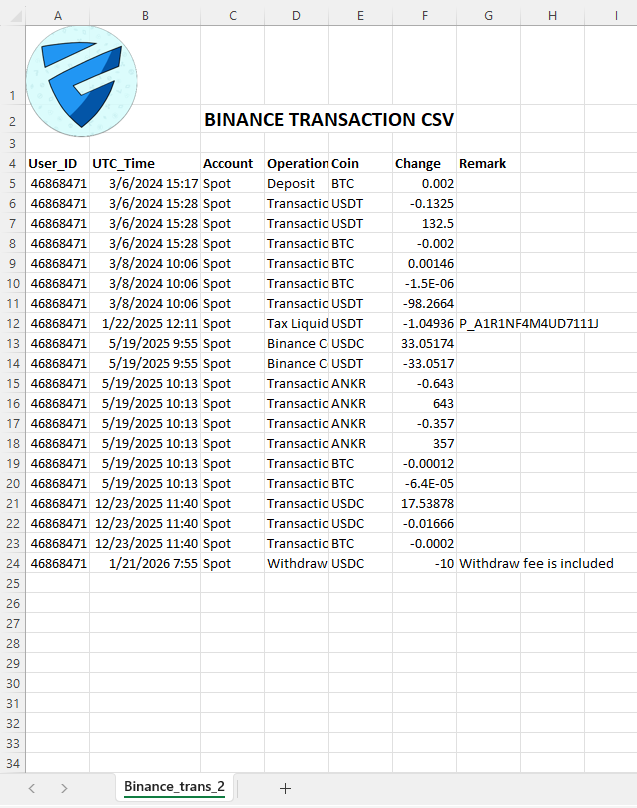

Why crypto CSV files are inconsistent

There is no shared standard for crypto CSV exports.

CSV files differ across providers in:

column names and ordering

transaction type vocabularies

asset and symbol naming

fee representation

timestamp formats and timezones

separation of trades, deposits, withdrawals, rewards, and other operations

As a result, CSVs from different sources may describe the same economic event using incompatible structures and meanings.

The normalization problem

Before crypto data can be used in Excel, it must be normalized.

Normalization includes:

cleaning and validating column headers

standardizing transaction types

normalizing asset symbols

converting timestamps to a consistent time basis

enforcing coherent quantity and fee semantics

removing structural ambiguities

Without normalization, Excel calculations and summaries are unreliable.

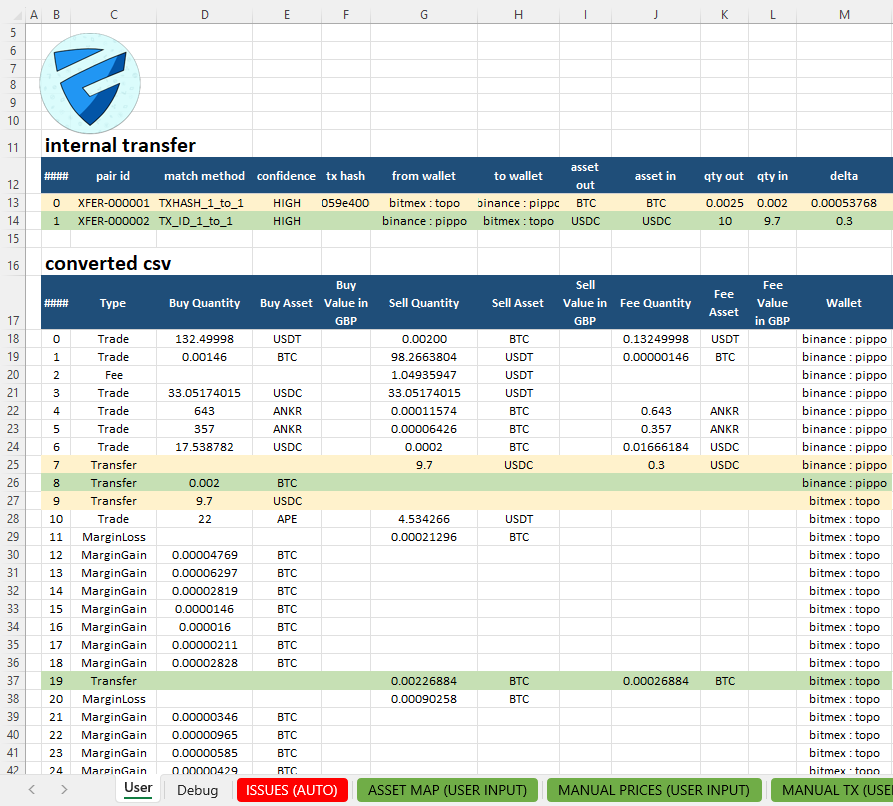

Multi-exchange and multi-wallet reconciliation

Most users operate across multiple exchanges and wallets.

This introduces additional complexity:

transfers appearing as withdrawals on one platform and deposits on another

duplicated or fragmented records

different fee accounting models

misaligned historical time ranges

Reconciliation is the process of identifying and aligning related records so that Excel reflects the underlying activity rather than a simple aggregation of CSV files.

Excel as the canonical data layer

Excel can function correctly only when it is fed with a canonical dataset.

A canonical Excel data layer means:

one row represents one economic event

each column has a fixed and unambiguous meaning

data is deterministic and auditable

all downstream logic starts from the same base

This turns Excel into a structured data reference, not just a collection of tables.

When data are structured we can perform a portfolio analysis and calculate crypto taxes

Excel as an interactive front end

In this architecture, Excel primarily acts as an interactive front end.

Excel is where users:

inspect and validate normalized data

filter, sort, and explore transactions

review reconciliation outcomes

intervene manually when data interpretation is ambiguous

All data ingestion, normalization, and reconciliation logic is executed in Python, outside of Excel.

Python is responsible for:

CSV parsing and validation

exchange- and wallet-specific normalization

deterministic reconciliation rules

construction of the canonical dataset consumed by Excel

Excel exposes the final result and remains fully interactive, while the underlying logic stays reproducible, auditable, and independent from spreadsheet formulas.

For those interested in understanding all the benefits of using Excel for crypto data analysis, CryptoExcel also provides a dedicated guide on the advantages of an Excel add-in for digital assets.

What good crypto data looks like in Excel

Well-prepared crypto data in Excel is:

exchange-agnostic

wallet-aware

chronologically consistent

free from semantic duplication

suitable for filtering, pivoting, auditing, and verification

Only at this stage can Excel be used reliably.

Typical use cases

preparing data for portfolio analysis

preparing data for tax calculations

reconciling historical activity across platforms

auditing transactions and balances

building custom Excel models on crypto data

Scope and internal links

This page covers crypto CSV ingestion, normalization, and reconciliation only.

For downstream applications:

FAQs

Are exchange CSV files already ready for Excel?

No.

Exchange CSV files are designed for data export, not for structured analysis in Excel. Column layouts, timestamp formats, transaction types, and fee handling vary widely. Without normalization, Excel processes structurally inconsistent data.

Why is reconciliation across multiple CSV files necessary?

Because the same operation can appear in multiple files with different meanings.

A transfer, for example, may show as a withdrawal on one platform and a deposit on another. Reconciliation aligns these records so Excel reflects the underlying activity correctly.

Does Excel perform the data normalization logic?

No.

Excel acts as an interactive front end.

CSV ingestion, normalization, and reconciliation logic is executed in Python. Excel exposes the resulting canonical dataset and allows users to analyze, verify, and interact with it.