Crypto Portfolio Excel

Managing and tracking a crypto portfolio in Excel quickly becomes complex when multiple exchanges, non-custodial wallets, and different operational strategies are involved over time.

For advanced users, the problem is not simply “seeing a balance”, but reconstructing the portfolio structure, its historical evolution, and real asset exposure, while maintaining full control over the data.

This page explains what it means to manage a crypto portfolio in Excel, why Excel remains the reference tool for professional analysis, and how to approach the problem in a structured way.

The real crypto portfolio problem

A crypto portfolio is rarely contained in a single place.

Over time, users typically accumulate data from:

multiple centralized exchanges

non-custodial wallets

internal transfers

on-chain activity

partial or time-limited CSV exports

This fragmentation makes it difficult to:

understand real asset exposure

correctly track portfolio evolution

compare different periods

verify numbers in an auditable way

In these situations, automatic dashboards and simplified tracking apps only show a final representation, not the underlying data model.

It is therefore essential to import and normalize crypto CSV files in Excel.

Why Excel remains the standard for portfolio management

Despite the availability of many SaaS tools, Excel remains the operational standard for professionals working with complex financial data.

Concrete reasons include:

formula transparency

direct control over transformations

step-by-step validation

custom analysis without platform constraints

integration with existing models

In crypto, Excel allows the portfolio to be treated not as a balance, but as a set of flows, positions, and states over time.

What “crypto portfolio” really means in Excel

In a professional context, a crypto portfolio is not just:

the current value

a list of assets

A structured portfolio includes:

asset positions

fund provenance

movements between wallets and exchanges

time-based evolution

consolidation of heterogeneous sources

In Excel, this becomes a data model, not a simple view.

Portfolio tracking: a function, not the goal

The term tracking is often associated with:

monitoring apps

automatic price updates

simplified visual dashboards

In Excel, portfolio tracking is a consequence of the model, not the starting point.

When data is:

normalized

consolidated

historized

tracking becomes natural:

exposure evolution

period comparisons

exchange or wallet-level analysis

anomaly detection

For users interested specifically in the operational side of tracking, there is also a dedicated guide on how to build a crypto tracker in Excel.

Building a crypto portfolio in Excel

A structured approach typically involves:

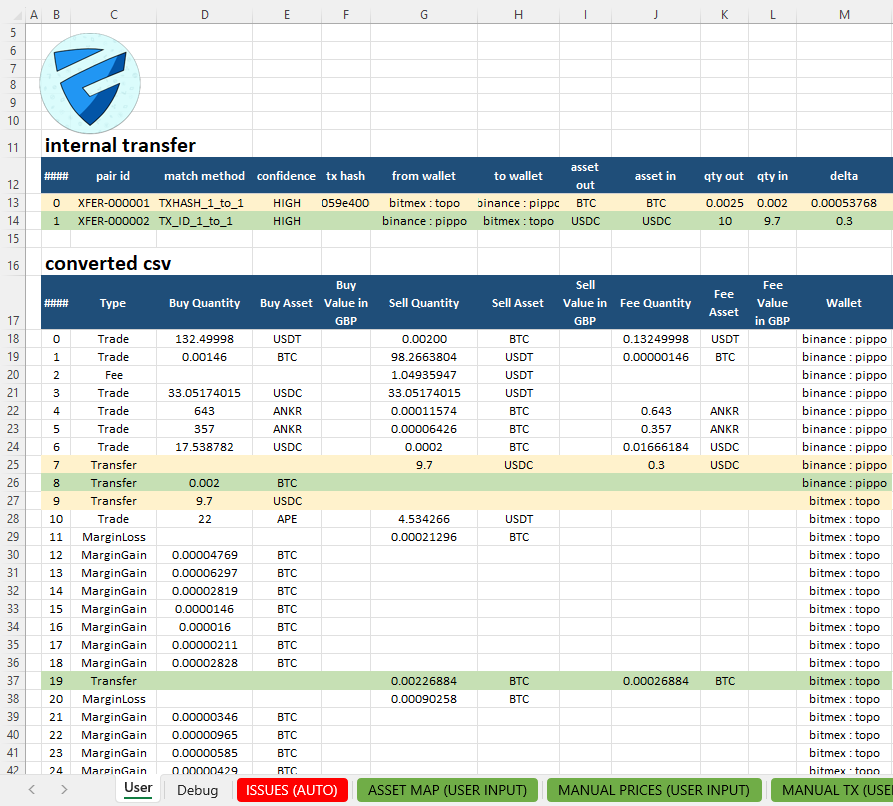

Importing data from exchanges and wallets

Normalizing assets, quantities, and operations

Consolidating everything into a single model

Analyzing data through Excel tables, pivots, and formulas

The goal is not to hide complexity, but to make it readable and verifiable.

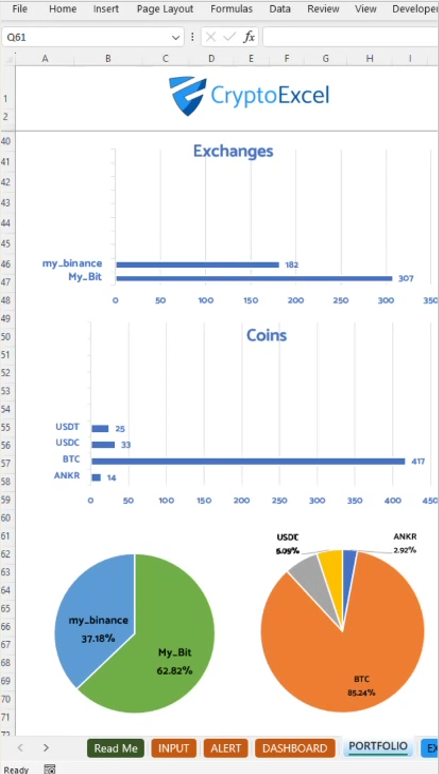

Typical Excel views

A crypto portfolio in Excel enables views such as:

consolidated portfolio by asset

exposure by exchange or wallet

historical position evolution

periodic portfolio snapshots

These views are derived from data, not from opaque predefined rules.

Who this approach is for

This portfolio approach is suited for:

active traders

multi-exchange users

professionals and advisors

Excel-centric workflows

It is not designed for:

occasional users

mobile-first “plug & play” solutions

users uninterested in understanding their data

Relationship with other domains

Portfolio management in Excel is often the starting point for:

advanced analysis

reconciliations

structured reporting

tax calculations

For this reason, the crypto portfolio domain is distinct but closely related to areas such as taxation and data normalization.

FAQs

Is a crypto portfolio in Excel the same as a tracker?

No. A tracker shows balances or snapshots. A crypto portfolio in Excel is a data model that includes flows, positions, and historical states, enabling verification and deeper analysis.

Is this portfolio approach meant for tax reporting?

Not necessarily. Portfolio management and taxation are separate domains. A structured Excel portfolio can be a useful foundation, but tax reporting requires dedicated logic and specific criteria.

Is it suitable for non-custodial wallets and multiple exchanges?

Yes. The concept of a crypto portfolio in Excel is designed to consolidate heterogeneous data sources, including multiple exchanges and non-custodial wallets, while preserving visibility and control.